Has the Saudi Arabia Petrodollar Agreement With the U.S. Ended?

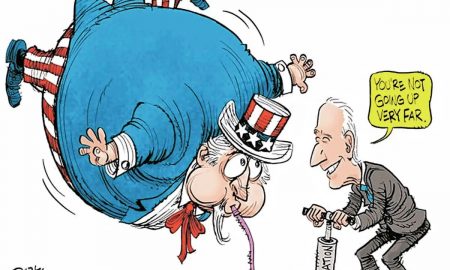

In the complex landscape of global finance, rumors and misinformation can spread faster than facts, leading to confusion about crucial economic agreements. A recent story claimed a seismic shift in the global economy, asserting that the Saudi Arabia petrodollar system had ended.

This claim suggests a pivotal change in how Saudi Arabia conducts its oil transactions, purportedly moving away from U.S. dollars—a cornerstone of global oil trade since the mid-20th century. However, the truth behind this claim is much less dramatic.

The Rumors of the 50-Year U.S.- Saudi Arabia Petrodollar Deal

Contrary to the swirling rumors, no formal 50-year agreement has bound Saudi Arabia to settle oil trades exclusively in U.S. dollars.

@aplasticplant | Instagram | No formal 50-year agreement has bound Saudi Arabia to settle oil trades exclusively in U.S. dollars.

This narrative seems to have been concocted to underline an anticipated decline in dollar dominance, perhaps to stir interest in alternatives like cryptocurrencies. David Wight, a historian who has extensively researched the petrodollar phenomenon, clarifies that his investigations into declassified documents reveal no such deal. Instead, what exists is a series of strategic financial relationships and policies enacted over decades.

Saudi-U.S. | Real Agreement With Different Stakes

The real deal between Saudi Arabia and the United States dates back to 1974, but it revolved around security and financial investments, not mandatory oil trading in dollars. The U.S. agreed to supply Saudi Arabia with advanced military technology.

In return, Saudi Arabia invested heavily in U.S. Treasury bonds, at one point reportedly owning up to 30% of the debt instruments. Today, the Kingdom holds about $136 billion in U.S. Treasuries, a stark decrease proportionate to the U.S.’s now nearly $35 trillion national debt.

@aplasticplant | Instagram | The real deal between Saudi Arabia and the United States revolved around security and financial investments, not mandatory oil trading in dollars.

Why the Dollar Dominates Oil Transactions

The persistence of the U.S. dollar in oil transactions, and indeed in international trade at large, is not due to any single agreement but rather the dollar’s overwhelming prevalence in global finance. The dollar offers the most favorable exchange rates due to its wide use, reinforcing its position through what economists call a ‘network effect.’

According to the latest figures from the International Monetary Fund (IMF), the dollar comprises 58% of global foreign exchange reserves, underscoring its central role despite recent declines in its share.

Shifts in Global Currency Dynamics

jcomp | Freepik | The persistence of the U.S. dollar in oil transactions is not due to any single agreement but rather the dollar’s overwhelming prevalence in global finance.

While the Saudi Arabia petrodollar deal may be a myth, shifts in global currency use are real. For instance, Saudi Arabia’s participation in the mBridge project—a digital currency initiative involving several countries, including China, which does not currently support dollar transactions—indicates a diversifying financial landscape.

Moreover, with China becoming a major oil purchaser from Saudi Arabia, there’s increasing discussion about using currencies like the renminbi for oil transactions, especially as China encourages the use of its currency in international trade.

Saudi Arabia also engages with the BRICS group (Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates), which advocates for using local currencies over the dollar in trade transactions. These moves suggest a gradual, albeit slow, shift towards less dollar-centric trade practices. Nonetheless, the Saudi Riyal’s peg to the dollar continues to incentivize the kingdom to maintain strong ties with the U.S. currency, which is crucial for its economic stability.

More in Wealth

-

`

Barbie Movies Are Outperforming Other U.S. Movies in China – Here’s Why

The Barbie movie is a huge hit in China! While lots of American movies usually do not do so well there,...

April 26, 2024 -

`

Hollywood Greatest Comebacks: Actors Who Staged Remarkable Returns

Hollywood may sparkle with glitz and glamor, but it’s a tough business. Stars who once basked in the spotlight can find...

April 26, 2024 -

`

Misinformation Is the New Normal: How You Can Spot Misinformation Online

In the ever-evolving world of the Internet, where information and misinformation intertwine like vines, it is essential to know how to...

April 25, 2024 -

`

America is Rich But Americans Are Poor | This Best-Selling Book Explains Why

In the midst of America’s wealth and global dominance lies a startling and often overlooked reality: The persistent existence of poverty....

April 25, 2024 -

`

What They Don’t Teach You in School About Money

From an early age, we’re told that going to school and getting a degree will set us up for financial success....

April 24, 2024 -

`

Work Presentations: How to Say Goodbye to Boring Office Meetings

Picture this: you’re in a conference room, surrounded by colleagues. The lights dim, a projector flickers to life, and there they...

April 24, 2024 -

`

Essential Documents for Opening a Business Bank Account: Your Checklist

Embarking on the entrepreneurial journey is exhilarating, but navigating the financial side of your venture requires thoughtful consideration. One pivotal step...

April 23, 2024 -

`

Gwyneth Paltrow Was Once Called out by NASA for This Bizarre Reason!

Once upon a time, Gwyneth Paltrow was considered to be one of the most promising actresses of her time. While she...

April 23, 2024 -

`

Discover the Royal Charm of Villa Maria Pia in Cascais, Portugal

Nestled on the sun-kissed north shore of Lisbon, the captivating town of Cascais, Portugal, harbors a secret steeped in royal history....

April 22, 2024

You must be logged in to post a comment Login