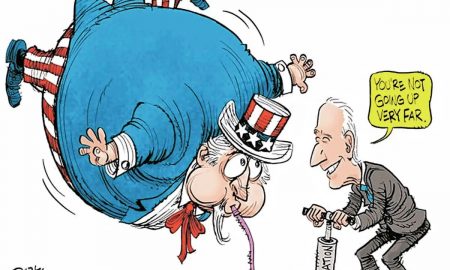

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ has suggested Google sell its popular Chrome browser to level the playing field for competitors.

The proposal is a centerpiece in the broader battle to break up Google’s dominance in search and online data.

However, the DOJ’s proposal is not just about Chrome. It also targets Google’s grip on search distribution and its strategic deals with smartphone makers like Apple to make Google the default search engine. These arrangements, which cost Google billions annually, are viewed as critical to maintaining its dominance. Prosecutors argue that stripping Google of these advantages will unlock opportunities for competitors to thrive.

Why the DOJ Wants to Break Google’s Monopoly?

Google’s monopoly over search and advertising ecosystems has been years in the making. By controlling both the distribution channels and the data flow, Google has created a feedback loop that cements its market leadership. Every search query feeds its AI models, attracting more advertisers and funding more innovation. Ultimately, leaving competitors in the dust.

Pixabay / Pexels / The DOJ’s recommendations propose mandatory licensing of Google’s search results and user data to competitors at minimal or no cost.

These measures are designed to dilute Google’s grip on data and restore competition. For smaller players like DuckDuckGo, these changes could be a lifeline. DuckDuckGo’s Head of Public Affairs, Kamyl Bazbaz, called the proposals a “big deal” that could finally lower barriers to entry in the tech space.

What is Google’s Response?

Unsurprisingly, Google is fighting back. Kent Walker, Google’s President of Global Affairs, described the DOJ’s proposal as extreme and unprecedented. In a company blog post, Walker argued that the measures would not only harm Google but also jeopardize user security and privacy.

Walker’s main concern is the forced sale of Chrome and potential restrictions on Android. He warned that these changes could degrade the quality of products millions of users rely on daily.

Likewise, Walker also labeled the proposals as an “overreach of government power,” claiming they would stifle innovation and hurt small businesses and developers.

How Chrome Fits Into Google’s Ecosystem

Chrome is more than just a browser. It is a gateway to Google’s entire ecosystem. From search to Gmail and YouTube, Chrome drives user engagement across the board. For competitors, gaining control of Chrome would mean access to a powerful distribution channel that Google has used to dominate search traffic.

Pixabay / Pexels / The DOJ argues that selling Chrome is the only way to prevent Google from leveraging it as a tool to maintain its dominance.

In their words, this step is essential to allow competitors to pursue meaningful distribution partnerships that could level the playing field.

What is at Stake for American Consumers?

IF Chrome is sold, it could lead to dramatic changes in the way Americans access online services. While the DOJ believes this will foster innovation, Google warns of potential risks. According to Walker, breaking up Google’s ecosystem could compromise user experience and diminish the quality of products many people consider essential.

Similarly, Google also claims the proposals could harm security. Chrome, integrated with Google’s advanced threat protection, plays a key role in safeguarding user data. Selling it to a competitor might weaken these protections, leaving millions of users vulnerable.

So, the fate of Google’s monopoly now lies in the hands of District Court Judge Amit Mehta. The trial stage is expected to kick off in 2025, giving both sides ample time to prepare their cases. The DOJ’s proposed measures are sweeping, including a five-year ban on Google re-entering the browser market if Chrome is sold. Prosecutors also want to prevent Google from investing in or acquiring rivals, including AI and advertising companies.

More in Business

-

`

Barbie Movies Are Outperforming Other U.S. Movies in China – Here’s Why

The Barbie movie is a huge hit in China! While lots of American movies usually do not do so well there,...

April 26, 2024 -

`

Hollywood Greatest Comebacks: Actors Who Staged Remarkable Returns

Hollywood may sparkle with glitz and glamor, but it’s a tough business. Stars who once basked in the spotlight can find...

April 26, 2024 -

`

Misinformation Is the New Normal: How You Can Spot Misinformation Online

In the ever-evolving world of the Internet, where information and misinformation intertwine like vines, it is essential to know how to...

April 25, 2024 -

`

America is Rich But Americans Are Poor | This Best-Selling Book Explains Why

In the midst of America’s wealth and global dominance lies a startling and often overlooked reality: The persistent existence of poverty....

April 25, 2024 -

`

What They Don’t Teach You in School About Money

From an early age, we’re told that going to school and getting a degree will set us up for financial success....

April 24, 2024 -

`

Work Presentations: How to Say Goodbye to Boring Office Meetings

Picture this: you’re in a conference room, surrounded by colleagues. The lights dim, a projector flickers to life, and there they...

April 24, 2024 -

`

Essential Documents for Opening a Business Bank Account: Your Checklist

Embarking on the entrepreneurial journey is exhilarating, but navigating the financial side of your venture requires thoughtful consideration. One pivotal step...

April 23, 2024 -

`

Gwyneth Paltrow Was Once Called out by NASA for This Bizarre Reason!

Once upon a time, Gwyneth Paltrow was considered to be one of the most promising actresses of her time. While she...

April 23, 2024 -

`

Discover the Royal Charm of Villa Maria Pia in Cascais, Portugal

Nestled on the sun-kissed north shore of Lisbon, the captivating town of Cascais, Portugal, harbors a secret steeped in royal history....

April 22, 2024

You must be logged in to post a comment Login