A Tech Bust? Goodbye To The Good Times In Silicon Valley

Have you ever visited a party, only to see the guests starting to leave? Although the music is playing and the food is ready to be served but you already know that the party’s over and that you won’t get much fun out of it. This is the case for most investors who are unaware of the duration of the correction in the private market.

However, this isn’t how Tiger Global Management likes to run things, and in a recent interview with the CEO, the company spilled the beans about the business, the environment, and the position of the company in the market.

So, if you’re looking to learn more about Tiger Global’s mechanism during times like these, then keep reading!

Rodnae/Pexels | You’re bound to learn a thing or two here

After a recent hinting towards the dotcom crash, CEOs and VCs have been on the edge of their seats, looking for a way to continue sailing, despite the big tide coming in. This market uncertainty came after an early-stage crypto firm sent its portfolio companies letters saying that they were now in a condition that’s very similar to the dot-com crash. The letter suggested that the founders should prepare for the worst.

Tiger Global Not Backing Down

Just like many other companies, Tiger Global also grew at a fast rate as venture capital investors but it doesn’t mean that they’re immune to facing losses!In 2022 alone, the company lost around $17 billion, making it one of history’s largest reported hedge fund losses. However, companies like Tiger Global, which work in the private and the public market, are among the first ones to predict a potential downturn because there’s a wide gap between the publicly-traded stocks and private stocks.

Pixabay/Pexels | You never know what’s about to happen next in Silicone Valley

It’s also these late-stage investors that are always on the brink of calling it quits on the public markets and are the first ones to close up their valuations and funding rounds to avoid facing any additional losses. In April of 2022, it was reported that the late-stage funding had fallen by 19% compared to the previous year while early-stage companies have been enjoying an upwards trend every single month of the year.

Pixabay/Pexels | The numbers need to stay up, up, up

The owners of these companies need to keep an eye out regarding the situation in the public markets as it serves as an indicator of the implications that can be faced by the private companies and shareholders.

More in Business

-

`

The Mesmerizing Transformation of Halsey: A Musical Icon Turned Makeup Maven

In the dynamic world of beauty and self-expression, Grammy nominee and former 30 Under 30 awardee, Halsey, has taken a remarkable...

April 18, 2024 -

`

The 10 Most Promising Investments in 2024

In the unpredictable world of investments, lat year surprised us with the stock market thriving against all odds. Despite looming recession...

April 18, 2024 -

`

Study Shows Employees Value Work-Life Balance Over Pay

Gone are the days of chasing the almighty dollar without a second thought. Randstad, the world’s leading employment agency, conducted a...

April 17, 2024 -

`

How to Get a Startup Business Loan with No Money: Your Step-by-Step Guide

Securing funding for your entrepreneurial dreams can feel like climbing Mount Everest without oxygen. It’s challenging, but there are paths to...

April 16, 2024 -

`

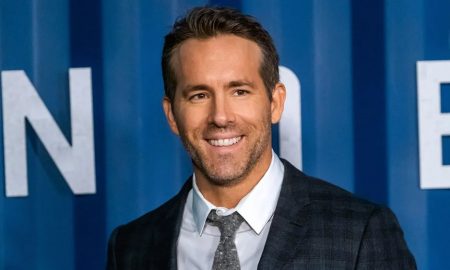

How Much is Ryan Reynolds Net Worth?

Ryan Reynolds, the quick-witted Canadian actor with a million-dollar smile, has carved a unique path to Hollywood stardom. But his journey...

April 11, 2024 -

`

Why Italy Is the Perfect Solo Adventure Spot

Embark on a soul-stirring solo adventure through the captivating landscapes and rich tapestry of Italy, where every cobblestone street whispers tales...

April 10, 2024 -

`

What is Provisional Credit and How Does It Work?

Have you ever checked your bank statement and noticed the term “provisional credit.” This term frequently appears during disputes or chargebacks....

April 9, 2024 -

`

Elon Musk’s OpenAI Lawsuit | Are OpenAI’s Financial Motives Overshadowing Its Mission Statement?

A recent legal battle has rocked the world of artificial intelligence (AI). It pitted Elon Musk against OpenAI, the research company...

April 8, 2024 -

`

Cultivating Prosperity: Lunar New Year Traditions for Financial Abundance

As we usher in the Lunar New Year, the traditions that accompany this vibrant celebration are not just a cultural spectacle...

February 10, 2024

You must be logged in to post a comment Login